For those who’re searching for a lower-Price tag chief from the self-directed IRA Room, RocketDollar has you lined. You’ll obtain use of every one of the alternative investment selections you’d be expecting from an SDIRA custodian and additional capabilities like “deliver your own offer” (BYOD), which lets you skip the custodian offer evaluation process.

The cost of physical gold may differ determined by many components. Many of these consist of provide and demand from customers, inflation and volatility in the U.S. dollar.

There are lots of compelling explanation why you ought to choose PhysicalGold.com for your gold obtaining desires. To start with, we provide terrific price and lower rates, thanks to our center on only the cash and bars very best suited for purchasers planning to maximise their income.

Least deposit and harmony needs may well range depending upon the investment vehicle chosen. $five hundred least deposit for investment accounts

How are IRA custodians regulated? IRA custodians are subject matter to strict laws set forth in The inner Revenue Code, holding them to large specifications of care and fiduciary duty.

The data contained During this tutorial will let you help you save 1000s of bucks in concealed fees and commissions. It is a need to-have.

What on earth is a self-directed IRA? Self-directed IRA investment possibilities The way to setup a self-directed IRA Advantages and disadvantages of a self-directed IRA Self-directed IRAs (SDIRA) permit you blog here to put money into almost nearly anything that’s investible — you’re not confined to straightforward investments which include stocks or bonds.

Gold cash, similar to the American Gold Eagle or Canadian Maple Leaf, are well-known collectables. This means you’ll possibly pay a premium about what you'll for a similar level of gold in the shape of bullion.

A self-directed traditional IRA comes along with the identical list of rules as an everyday traditional IRA—you may get a tax break now by deducting your contributions from a income, but you will have to fork out profits tax once you just take dollars out of your account in retirement. Having a self-directed Roth IRA, you pay back taxes on The cash

The list of suitable investments directory could go additional if you could find an IRA custodian who’s willing to perform along with you (additional under).

Much like normal IRAs, it is possible to make a choice from two kinds of different self-directed IRAs: traditional or Roth. Each varieties of self-directed IRAs contain the similar contribution limitations as regular IRAs, and you will only just take cash out of the account without having obtaining strike with early withdrawal penalties if you find yourself 59 one/two several years aged.

Liquidity possibility is without doubt one of the several reasons that a self-directed IRA should really only incorporate a portion of your retirement savings.

But before you opt to open up up a self-directed IRA, You should weigh The nice, the negative as well as ugly. While there are a few intriguing reasons to open up a self-directed IRA, there are lots of prospective pitfalls which could end up leaving a gaping hole with your nest egg. Professionals

That is as the buyback rate, or bid, is decrease than the inquiring cost. The difference between the two is referred to as the distribute, and it is a loss that the vendor originally bears.

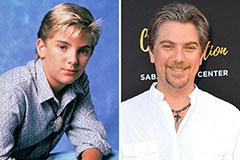

Kel Mitchell Then & Now!

Kel Mitchell Then & Now! Mason Gamble Then & Now!

Mason Gamble Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Robbie Rist Then & Now!

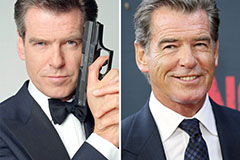

Robbie Rist Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!